Both small business optimism and financing approval rates increase in December 2017

In November of December of 2017, we saw an increase in optimism whereby small business owners were optimistic about their economic prospects. This sentiment was largely the result of the Republican Tax Bill pushed through by President Trump and the Republicans.

Recent economic data in the form of the latest U.S. Small business Credit Monthly Report from PayNet seems to corroborate this. The Thomson Reuters/PayNet Small Business Lending Index (SBLI) for the month of November, rose 4.1 percent – from 133.2 (revised) in October to 138.7 in November. It now sits more than 7 percent above levels from one year ago. The SBLI 3-month moving average also increased, rising 6 percent above levels last seen in November 2016

Made up of 18 different economic sectors, 11 of those sectors saw lending increases over the last 12 months, including seven sectors that grew by over 4 percent. The fast-growing sectors include Construction which saw an increase of 5.3% and saw growth for 11 consecutive months. In the meantime, only two sectors saw significant declines: Finance and Insurance falling -3.6% and Healthcare falling a whopping -8.8%

“After lagging for most of the year, small business investment is finally starting to pick up”, said William Phelan, President of PayNet. “Financial health remains solid and small businesses are well-posiitioned to expand through responsible borrowing.”

Small business financing approval rates increase

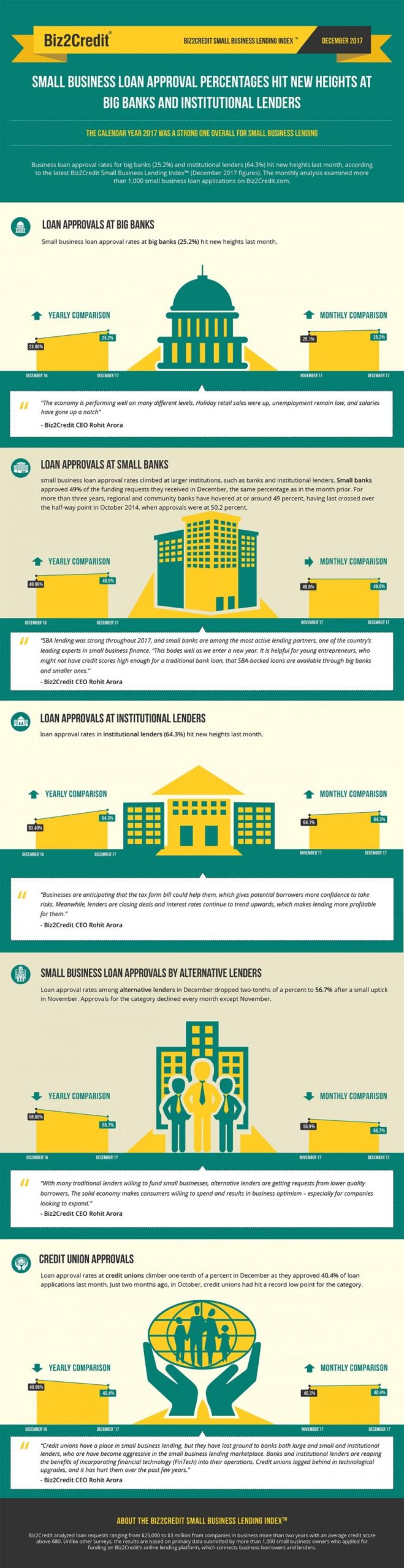

Increases in lending were not just limited to small business optimism. financing approval rates at big banks and institutional lenders also increased reaching new highs in December 2017. According to the Biz2Credit Small Business Lending Index, this increase extended for yearly comparison for both segments, resulting in higher approval rates.

The survey which comes from an analysis of 1,000 financing application from the Biz2Credit website found that small business financing approval rates for big banks came in at 25.2 percent, a 0.1 percent increase from November and a 1.3 percent increase over December 2016.

What is driving the increase in small business optimism and financing approval rates? A strong holiday season, US tax reform, higher salaries, more jobs and higher interest rates all played a role.

According to Mastercard, record holiday sales were in part responsible, increasing 4.9% over last year. Additionally, the Small Business Report by ADP reported that the private sector added 250,000 new jobs in the month of December with 38% or 94,000 of those jobs within firms with 1 and 49 employees.

What does 2018 have in store?

Small business owners looking for financing have reason to be optimistic in 2018. Many small business owners are holding out hope that the business-friendly Trump administration will continue making policy and regulatory changes that are favorable to them going forward into 2018.

If you are one of the many small business owners looking to grow your business and sales., Zip Capital Group can help. We specialize in working capital financing for business in all types of industries.

Apply for your working capital financing today or call 1 800-795-3919 to speak to a Working Capital financing Specialist.

Source: Smallbiztrends.com