Improvements at big banks doesn’t hide the fact the threat that FinTech poses to the bank and finance industry

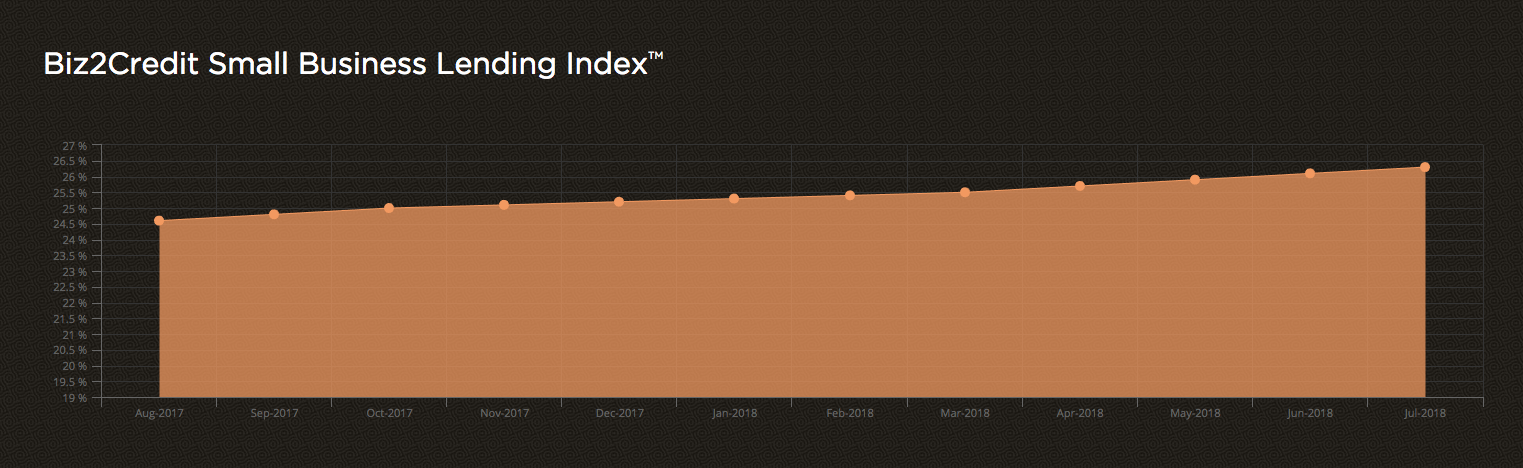

According to the Biz2Credit.com small business lending index , big banks are approving more small business loans than they have in the past. Recent analysis suggests that the big banks are approving more than 1 in 4 or 25% of loan requests received. This is the first time such approval rates have been seen since 2011.

While loan approval rates for small businesses are increasing at big banks, the index also shows that they are receiving more loan applications as well. However, the amount is negligible, at best.

Between June and July 2018, loans approved by big banks increased from 26.1% to 26.3%. In contrast, loan approval rates by smaller banks during the same period increased from 49.6% to 49.7%, slightly less than approval rates at the big banks.

Why are approval rates increasing at big banks? Are there other forces at play?

Increasing loan approval rates at the big banks could be reflecting in part, the improving economy, at least as far as employment rates are concerned (). They could also be reflecting the strength of their recovery after the financial crisis of 2008. The big banks after all, did receive an exceedingly generous bailout package, courtesy of American taxpayers ().

Despite the increase in loan approval rates by big banks, we can’t lose site of the fact that there is a massive shift taking place in the financial services and banking industry. For the first time, the established financial services industry or banks have competition in the form of fintech companies.

What is fintech?

‘Fintech’, short for financial technology, simply put are the computer programs and applications used to support or enable banking and financial services. It previously used to refer to the ‘archaic’ plumbing and infrastructure that made up the back office operations of banks and financial services companies. These were systems that were designed and built decades ago with many based upon ‘mainframe’ technology. Thirty and forty years later, these same systems are the backbone of what is the current financial system().

Around 2010, the definition of ‘fintech’ was expanded to include technological innovation in the financial services industry. This includes financial education, retail banking, wealth management, personal and business lending as well as cryptocurrencies and blockchains. Cryptocurrencies and blockchain technology fall within the ‘fintech’ umbrella since they are, at their core payment mechanisms.

While fintech has been around for awhile now, it is only within the last few years that it has become increasingly popular on several fronts including the banking and financial industry, amongst consumers and with investors.

Response by the financial services industry

Changing consumer preferences towards ‘mobile’ and self-service banking combined with a tight regulatory environment has limited the finance and banking industry to expand and pursue growth opportunities. As a result, new technologies and innovation in the financial and banking industry has been driven by the fintech companies.

Examples of the transformation of the financial sector in terms of the delivery of financial services includes:

- Online loan applications and powerful loan analysis tools

- Mobile payment applications enabling faster transaction payment and settlement

- Crowdfunding providing new sources of financing to start-ups and risky businesses, and

- Artificial intelligence applications to improve ‘back-office’ operations and provide personalized portfolio and investment advisory services.

The financial and banking industries realize that fintech poses a threat to their sales and revenues and are responding accordingly. They have mounted aggressive acquisition campaigns to buy the technology and integrate it into their revenue portfolios. This trend is reflected in fintech investments discussed below.

Fintech and consumer adoption rates

Consumers around the World are rapidly integrating fintech into their financial lives. Ernst and Young completed an extensive survey of 22,000 digitally active consumers across 20 different developing and mature markets. The study identified four key consumer themes, including:

- Fintech has achieved initial mass adoption across countries.

- New services and players are driving adoption

- Fintech users prefer using digital channels and technologies to manage their lives, and

- Fintech will continue to gain momentum

Amongst survey respondents, the percentage of digitally active consumers who have used each product is as follows:

- 50% for money transfer payments

- 24% for insurance

- 20% for savings and investment

- 10% for lending

- 10% for financial planning

The main take-away from the study was that fintech adoption has reached a ‘tipping point’ into mainstream adoption across societies.

A key thing to keep in mind is that in many instances, revenues going into fintech are revenues that are not going banks and established financial intermediaries.

Fintech investment

Fintech has not only attracted the attention of consumers and banks around the World. It also has the attention of investors. Investment in fintech has been growing very rapidly in not just the United States, but around the World.

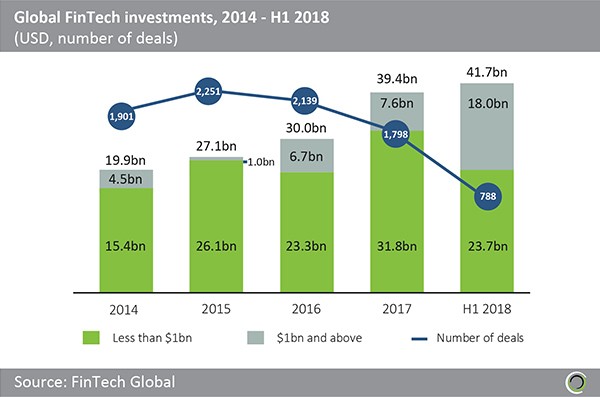

Between 2014 and 2017, global fintech investments grew from $19.9 billion to $39.4 billion. This represents a compounded annual growth rate of 18.5%.

Growth rates in terms of money invested show no signs of slowing down. In the first half of 2018, the amount invested in fintech exceeded the total invested for all of last year, $41.7 billion over 789 deals.

It is worthwhile to point out that the number of deals has been steadily declining from a peak of 2,251 deals in 2015 to 789 deals, so far this year. The increasing transaction size for each deal,, combined with increasing consumer adoption rates is indicative of a maturing fintech sector.

In conclusion

Improving loan approval rates and recent increasing deal flow to big banks does not discount the potential threat that fintech represents to the financial and banking industries.

Interest in fintech is increasing on several fronts, including:

- Within the banking and financial industries

- Amongst consumers, and

- With investors

In the end, when there is increasing competition within an industry, it is the consumer that ultimately benefits.

Entrepreneurs and small business owners will have more choices when it comes to the merchant cash advance needs. Zip Capital Group focuses on the financing needs of entrepreneurs and small business owners.

To contact a Zip Capital Group Small Business Specialist, call 800-795-3919. You can also apply for a merchant cash advance online.