FinTech, or financial technology is providing better service to more people. As a result, merchant cash advance providers are taking on the banks and financial institutions

Merchant cash advance providers are taking on the banks!

‘FinTech’, short for financial technology is the term given to financial services firms whose product or service is built upon technology. As a result, merchant cash advance providers may be able as a result of technology, may be able to better meet the needs of entrepreneurs and small businesses better than banks and traditional financial service providers.

As recent as a few years ago, entrepreneurs had a limited number of options when it came to funding their business. It was primarily friends and family, credit cards and small business loans.

Small business, commercial and personal loans have historically been the domain of traditional banks. Banks have traditionally required high credit scores, collateral, and a great deal of time to complete the application. It often helped a great deal of you had a preexisting business relationship with the bank.

Merchant cash advances, a lump sum payment in exchange for a percentage of receivables or future cash flow is becoming an increasingly popular and convenient way for entrepreneurs and small businesses to secure operating capital to grow their business.

Cutting edge companies such as Zip Capital Group are leveraging technology to build risk profiles of clients and to market and distribute merchant cash advances to entrepreneurs and small businesses throughout the United States.

Benefits of a merchant cash advance to entrepreneurs and small businesses includes:

- Fast access to working capital, usually within 24 to 48 hours of starting the application process,

- A fast and streamlined application process.

- Risk profiles based upon financial metrics and other factors, rather than an extensive credit history

- Better customer service and support

There is an additional benefit of fintech that is addressing a big problem in not only the United States but the entire World. While traditional banking services have worked for many, there is a segment of the population that has been exempt from access to capital. So big is the size of this group that they have a name, the ‘unbanked’.

The size of ‘the unbanked’

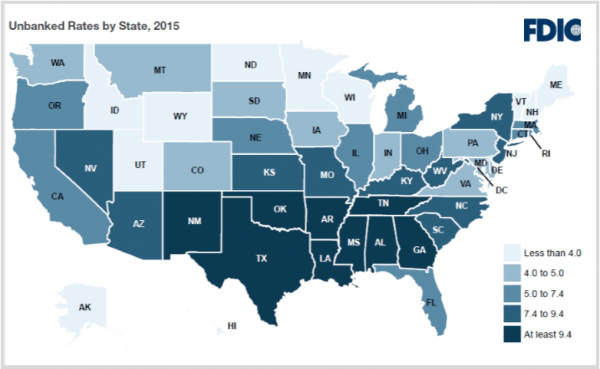

A 2015 survey by the Federal Depositors Insurance Corporation (FDIC), the government agency responsible for insuring bank deposits at FDIC-member banks, found that about 7 percent of households in the United States are unbanked. This represents an estimated 9 million households.

Source: Ctbythenumbers.com

The study also found that an additional 19,9 percent, or 24.5 million households in the United States were underbanked. In other words, 24.5 million households in the United States had a checking or savings account but also obtained financial products and services from outside the banking system.

In total, 33.5 million of the 126.6 million households in the United States either don’t have access to banking services or are not using them to their full potential.

This is more than a quarter of all households in the United States. Considering that the United States is one of the most economically advanced countries in the World, these numbers are shocking.

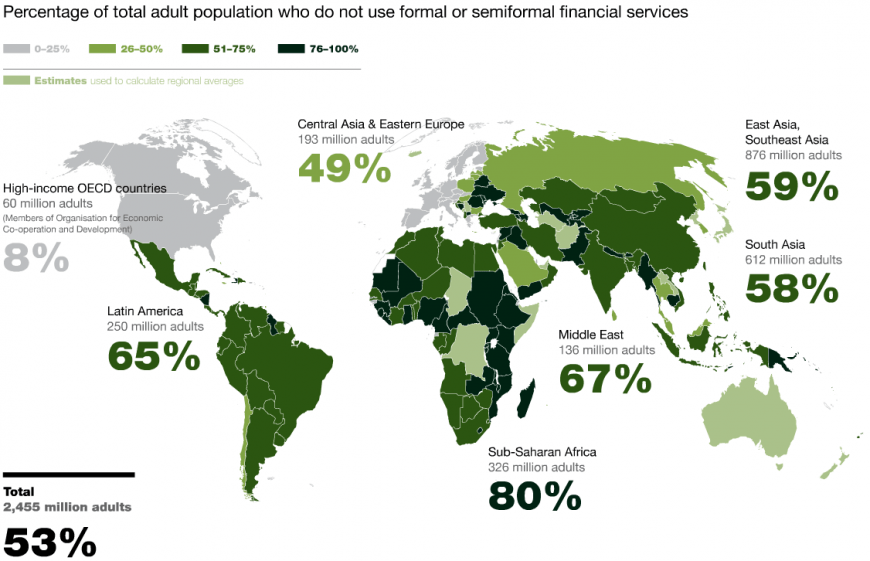

When looking at the problem of a lack of access to banking services globally, the quantity of individuals without a bank account is tremendous. According to the World Bank, 2 billion people around the World don’t have a bank account. This is after the fact that almost 700 million people have opened a bank account since 2011.

Source: McKinsey

Inefficiencies in the Bank borrowing process

Taking out a business loan from a traditional bank has long been known to be a tedious, costly and sometimes difficult process. It can sometimes take days and weeks to prepare a loan application as many banks will often require business financial statements such as cash flow and income statements as well balance sheets. Oftentimes, collateral is also required for a bank loan. This can add additional time to the application process as appraisals and valuations may be required.

Once a completed loan application has been submitted to a bank, it may be required to go before a loan committee for review. This process can add several additional days or weeks to the application process alone, depending upon how much additional information is requested by the reviewing party. For larger loan amounts, it is not uncommon for a loan application to go before committee several times before a final decision is rendered as additional information may be requested by the reviewing party. The end result is delayed access to much needed funding.

Once a loan is approved, there is the matter of underwriting and funding the loan. It is during this time that loan documents are prepared for signing and the loan is funded. Depending upon the bank’s workload, internal bank processes and the amount of related paperwork, the underwriting process can take anywhere from a few days to a weeks to complete.

Considering how the time and resources of most small business is at a premium, the completion of a small business loan application is done at a significant cost to the business owner. To add insult to injury, the services of an advisor such as an attorney or accountant may be required to prepare financial statements and the like. The cost of these services are often borne by the small business owner completing the loan application.

The high cost of the traditional banking industry

The cost, time, and inefficiency describing the small business loan application process does not just apply to trying to borrow money from banks. It can also be used to describe the banking system as a whole, and not just from within the United States, but rather globally.

Consider the settlement process for a stock trade. Whether a stock be traded on an electronic or stock exchange, the entire process is still ‘t + 3’. In other words, once a stock is traded, it will take at least three days to receive the proceeds from your trade.

Additionally, a domestic bank wire can take 24 hours to complete. Better yet, an International bank transfer can take several days to complete.

In contrast, Bitcoin and Ether can be traded on cryptocurrency exchanges such as Binance.com or Coinbase.com and settle very quickly. Settlement can take place within seconds to a few hours, depending upon exchange activity.

When one considers the number of households within the United States and the number of people without access to banking services, whether by choice or circumstances, lack of accessibility becomes very apparent.

The rise of Fintech

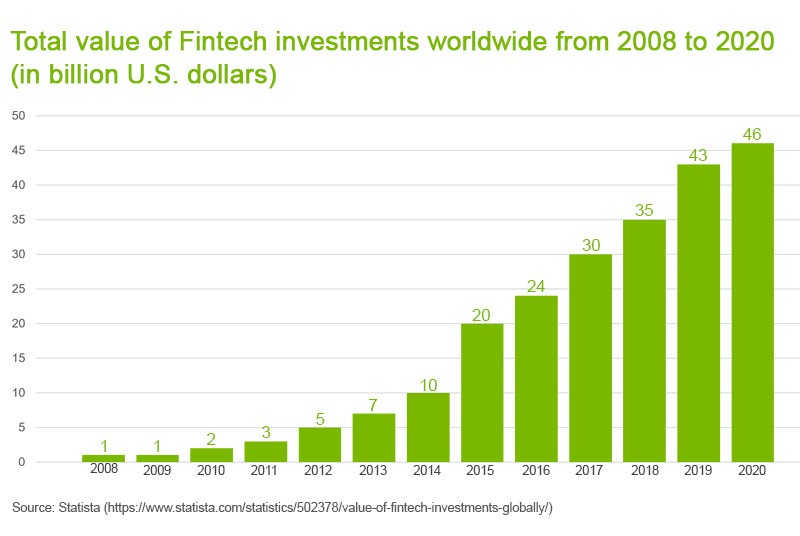

Fintech companies directly compete with banks in most areas of the financial sector to sell financial services and solutions to customers. Investment in financial technology is increasing expected to reach $46 billion by 2020.

Most, if not all of these technologies rely upon the Internet, desktop computers, and mobile devices as sales, marketing and distribution channels. As a result, financial services, including money transfer, lending, investing, payments, and more, can be distributed on a wider scale, at a much lower cost than the traditional banking industry. Such cost savings can open up a whole new range of financial services to segments of the populations that previously did not have access to such services.

The current generation of fintech companies are taking things to another level by creating new products and services that are optimized for the Internet. For example, crowdfunding, the process of raising small amounts of capital from many investors online is not just limited to individual circumstances, causes, and projects but rather is expanding to include equity funding and real estate.

The net effect of fintech as a whole is about increasing accessibility. Investment opportunities and services that were previously reserved for the wealthy, is now increasingly being made available to everyone with the desire to invest.

Merchant Cash Advance as Fintech

Whereas the traditional banking industry relies in large part to credit scores to determine creditworthiness, fintech lenders are leveraging technology to assess risk.

Credit scores rely upon an applicant’s credit history to determine creditworthiness. If an applicant has not previously borrowed from a financial institution, there is no history and as such, no basis from which to make a loan. As a result, an applicant is likely to have their loan rejected. This process limits many entrepreneurs from securing the capital needed to grow their businesses.

In contrast, fintech lenders will look at many online data points to create a risk profile for a prospective borrower. Software will look at many pieces of information such things as social media profiles, public records, banking relationships, and the applicants underlying cash flow to determine the probability of repayment.

A funding decision for a merchant cash advance is done independently of a credit history and instead relies upon the applicant’s cash flow and other factors to determine feasibility. As a result, some applicants who previously did not have access to capital can now access the funds needed to grow their business. Additionally, unlike many traditional small business loans, a merchant cash advance does not require collateral. A merchant cash advance is unsecured.

Fintech efficiencies – Merchant Cash Advance

Whereas the application process for a small business loan may have taken many days, most likely weeks and in some cases months, the entire merchant cash advance application process may take days. As an example, Zip Capital Group can fund a merchant cash advance in many cases within two business days of when the application is submitted.

Not only is there the added convenience of funding a cash advance shortly upon completion of the online application process, the applicant is funded when they actually need the money. The time when they actually complete the application process.

With many traditional bank loans, because of the passage of time between the application process starts and when the business loan is funded, the crisis that brought about the need for funding may have passed. As a result, the money that they receive will have reduced utility compared to when they most needed the money.

Business owners and consumers have long accepted the inefficiencies and costs of doing business with traditional financial intermediaries. The increasing importance of fintech may result in pressure being placed upon existing financial institutions to provide better service at a lower cost in a timely manner or risk losing business. They have every incentive to change as they risk losing business to companies that better meet the needs of their clients.

Conclusion

Merchant cash advances, made popular through the use of technology is addressing pressing problems for many entrepreneurs and small businesses. These problems include a streamlined application process, access to funding without a credit score and collateral, and the receipt of funds in a timely manner.

Zip Capital Group, is a merchant cash provider helping entrepreneurs and small business owners meet their working capital needs.

Learn more about our offerings, contact us with questions, or apply online to get the working capital you need to grow your business to the next level.

Merchant cash advance providers are taking on the banks. Fintech is the tool that is enabling them to do that. The best part is that it is the ‘unbanked’, ‘underbanked’ and small business owners and entepreneurs who may come out ahead.