The leading economic indicators are closely followed by government, investors and business. Which of the leading indicators matter most to small business?

Wall Street, the mainstream media and the government monitor economic conditions for information about where the economy is in the business cycle.

There are also coincident and lagging indicators that reveal information about the location of the economy in the business cycle. All three types of indicators are used by investors, economists, and business to determine where the economy is in the business cycle.

A leading indicator is any economic factor that changes before the rest of the economy begins to go in a particular direction. They help market observers and policymakers predict significant changes in the economy. However, they are not always accurate.

Economic indicators are what the “experts” tell us what lies around the corner. Specific leading indicators include:

- Interest rates

- Durable goods orders

- The stock market

- Manufacturing jobs

- Consumer sentiment, and

- Building permits

While all of the leading economic indicators contain valuable information in their own right, which leading indicator do small and medium-sized businesses feel is most accurate?

We can’t discount the important role that small and medium-sized businesses play in the economic landscape of the United States. Employer firms with fewer than 500 workers employed 46.8 percent in private sector payrolls in 2016, employers with fewer than 100 workers employed 33.4 percent and firms with less than 200 employees, 16.8 percent.

If a recent survey from Bill.com is to be believed, small business and medium sized business owners say that the number one key indicator affecting their business is consumer confidence. Nearly half (46%) of small businesses surveyed say that Consumer Confidence has the most impact on their business.

What is the Consumer Confidence Index?

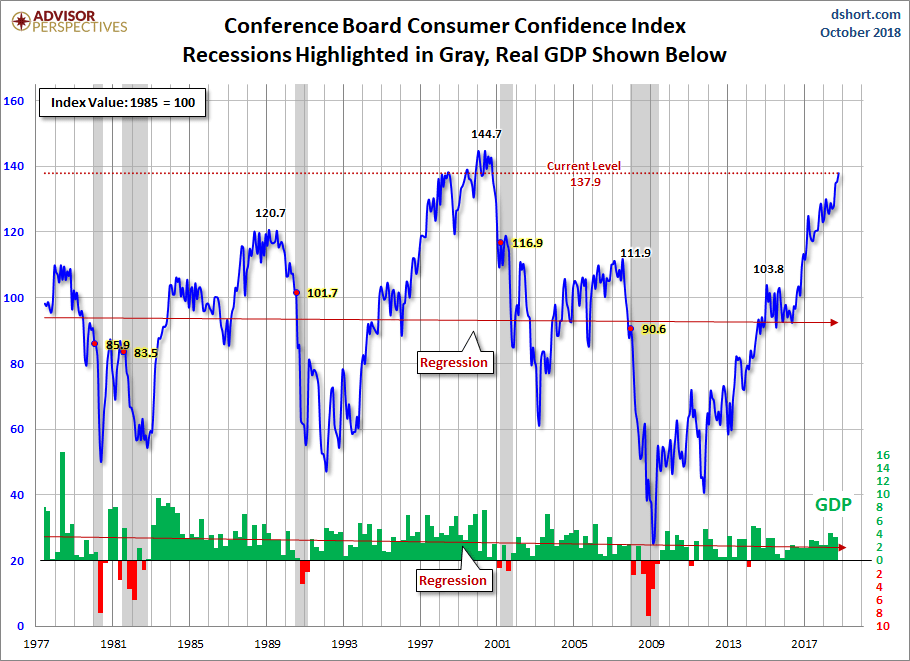

The Consumer Confidence Index is a survey by the Conference Board, an independent membership-based research organization that measures how optimistic or pessimistic consumers are with regard to the economy in the near future. The index is based on the concept that if consumers are optimistic, they tend to purchase more goods and services. This increase in spending eventually ends up stimulating economic growth.

The Consumer Confidence Survey of 5,000 households takes place monthly and consists of five questions. Two of the questions relate to present economic conditions with the remaining three questions related to future expectations.

A survey respondent has one of three options regarding their answers: positive, negative, and neutral. The index was set to 100 in 1985.

The 2018 Bill.com Small and Medium Business survey

Bill.com, a leading bill payment processing service surveyed 1,700 small and medium-sized businesses across the US to determine their sentiment about the economy as it relates to their business.

Overall, a large number (78%) of small and medium-sized businesses are expecting economic conditions to stay the same or improve in the coming year. Additionally, 66% say that they are better off financially than they were a year ago.

The Bill.com survey revealed additional information as well. A large number (78%) of small businesses are concerned about tax policy and how it will affect their businesses.

Taxes were not the only things on the minds of small and medium-sized business owners. 64% of small business owners also worry about healthcare legislation and how potential policy changes may impact them.

Local small business regulations were also of concern for 59% of small to medium sized businesses surveyed. Immigration policy was of concern for 45% of respondents while 42% of small businesses were concerned about tariffs.

When asked about the Bill.com survey, Tanya Roberts, VP of Corporate Marketing says “what doesn’t change is the profound effect these factors can have on a business’ financial health”. She continues “they impact cash flow –which is always a key determinant of whether small or medium-sized businesses get paid on time”.

What do you think? Is there a better leading indicator for your business?

If you are a small business that does not want to go through the extensive documentation process for an SBA loan, or will not qualify, and need your funding tomorrow, please give us a try. Contact us or complete an application online.