Your balance sheet is a key part of your financial statements. Learn how to manage your balance sheet for success.

As a small business owner, the success or failure of your small business hinges on your ability to manage your finances. Your ability to secure funding for your business, whether it be from investors, a merchant cash advance or an SBA loan rides on your financial statements. A strong financial position is reflected in your financial statements, increasing the likelihood of securing credit having favorable terms. Most importantly, a strong financial position is associated with a successful business and reflects good management. It is also a key indicator of the long-run viability of your business. In this blog post, you will learn how to manage your balance sheet for small business success.

In our three most recent blog posts, we addressed activities to improve the cash flows of your small business. Specifically, we wrote about planning for disruptions to your cash flows, 10 steps to better manage your cash flow in times of crisis, and how to optimize your cash flows.

We are going to remain on the theme of writing about key financial management strategies and advice to improve your small business. However, we going to pivot slightly by addressing your balance sheet, of one of three financial documents for every business, household, and individual.

In this blog post, we will learn:

- What is a balance sheet?

- What are the components making up a balance sheet, specifically, assets, liabilities, and shareholder’s equity?

- What is the relationship between your balance sheet and income statement?

- What is the relationship between your balance sheet and statement of cash flows?

- How to analyze your balance sheet?

Without further ado, let’s get going and learn about how to manage your balance sheet for success.

What is a balance sheet?

There are three main financial statements: the balance sheet, the income statement, and the cash flow statement. The balance sheet gives a snapshot of a business’s financial health at a certain point in time. It balances assets with liabilities to give you an idea of the liquidity of your business. As a business owner, you know your balance sheets are important not only for financial statements but also to ensure all your money is accounted for.

What are the components making up a balance sheet?

There are five main sections of your balance sheet: current assets, long-term assets, current liabilities long-term liabilities, and shareholder equity.

What are current assets?

Also known as short-term assets, current assets include anything that can be easily converted into cash. Current assets are listed in order from the most liquid to least liquid. This way you can tell which items will bring money into your business if you sell them quickly. I want to point out that assets that can be easily converted into cash are not the same thing as cash flow.

Current assets include:

- Cash on hand

Accounts receivable – Money owed to a company by its debtors

- Short-term investments – traded investments that are easily convertible into cash

- Prepaid insurance

- Inventory

What are long-term assets?

Long-term assets are investments or things owned which are used in the business for more than one year. On your balance sheet, a long-term asset is also a fixed asset.

What are fixed assets?

Fixed assets are anything that is used in the business for long periods of time or permanently: buildings (rented or owned), machinery, furniture, tools, and fixtures. Fixed assets are intended to be used for a long time and are difficult to convert to cash.

What are Investments classified as long-term assets?

Similar to a fixed asset, investments classified as long-term assets are investments that the business does not plan to sell within a year. Such investments include stocks, bonds, exchange-traded funds, and cryptocurrencies the business intends to hold.

What are intangible assets?

These are assets that are not physically present but still have value. They can include patents, copyrights, trademarks, goodwill, and franchise rights.

What are small business liabilities?

A liability represents a financial obligation of a business. Defined as a current claim against the business arising from past transactions or events, these are monies owed by the business.

What are short-term liabilities?

Also known as current liabilities, these are liabilities that you will pay for within one year. They include:

Accounts payable

Accounts payable are monies owed to your vendors and suppliers. It is recorded on your balance sheet under short-term liabilities. Accounts payable reflect credit extended to your business.

Trade accounts

Trade payables

Is money a company owes its vendors for inventory-related goods, such as business supplies or materials. Accounts payable on your balance sheet include all of the company’s short-term debts or obligations.

Accrued expenses

These include wages, interest, taxes, and other expenses that accumulate for your small business. They include expenses that your small business plans to pay at a future date. For example, your employees may earn income that you pay at a later date.

Taxes payable

Taxes owed to the government due within one year.

Dividends payable

These are portions of your company’s earnings that are payable to shareholders if you have shareholders.

Customer deposits

Many small businesses receive monies in advance of delivering goods or services to a customer. For example, a business may ask for a deposit in advance of delivering a finished product to the customer.

Short-term debt

This is any debt or liability that is due within a year.

Current portion of long-term debt

Long-term liabilities are due in a period of time longer than a year. However, debt service payments on your long-term liabilities due within a year are classified as short-term liabilities.

What are long-term liabilities?

These are liabilities that do not need to be paid off within a year. They include:

Long-term loans

These are loans that are paid off in a time period greater than one year. For example, a mortgage, a vehicle loan, or a note on your machinery. Long-term loans reflect credit extended to your business.

Capital leases

A capital lease is a financing technique that allows businesses to lease their equipment or other expensive assets for years instead of buying them outright. For example, a business may lease a factory for ten years. Instead of having to purchase the factory outright, the business borrows money to buy the facility. It then pays back this loan over the course of ten years through periodic payments, usually one month’s rent per year.

The following two classes of long-term liabilities primarily pertain to larger, more mature businesses, and I am including them here in the interest of completeness.

Pension liabilities

Pension liability on a balance sheet is a liability of interest to the pension plan. It is the amount of money or assets that a business has promised to pay to its employees as a retirement benefit. For example, a business may have promised their employees that when they retire at age 65, the business will pay half their salary for the rest of their life. In order for the employees to be able to continue working after retirement, they will need health insurance and income replacement. For a business, these benefits would be paid for by the business itself or an investment account fund set up to manage funds on the retiree’s behalf.

A post-retirement healthcare liability means that the business is responsible for paying the medical expenses of a retired employee. Those expenses may arise from a disability during employment or those incurred after retirement due to a pre-existing condition.

Pension and post-retirement liabilities primarily apply to larger companies in this day and age and not so many small businesses. However, I thought it was important to include in this conversation.

Deferred revenues

Deferred revenues on balance sheets occur when you have a customer that pays your business for a product or service, but they don’t pay their entire bill at the same time. Most businesses will defer this payment over a period of time. Deferred revenues are included in the liabilities section of the balance sheet. If the customer will be paying in full within the year, it is classified as a current liability. If payment is expected in more than a year, it is a long-term liability on your balance sheet.

Deferred revenues are not reflected on your income statement. It is reflected on your income statement as the income is earned, with the liability decreased on your balance sheet as it is recognized as income.

Deferred compensation

Deferred compensation is a portion of an employee’s compensation that is set aside to be paid at a later date. In most cases, taxes on this income are deferred until it is paid out. Forms of deferred compensation include retirement plans, pension plans, and stock-option plans.

Deferred income taxes

Deferred tax is an obligation that exists on the balance sheet when there is a difference between your book income and taxable income. This can occur because of timing differences or temporary differences that are the result of accounting rules.

A company’s short-term liabilities and long-term liabilities are their total liabilities.

What is shareholder’s equity?

The last section is shareholders’ equity, which is equal to your ownership stake in the business before paying any dividends. To determine your shareholder’s equity, you will need to know the difference between assets and liabilities. In other words, this is what you, the business owner or business owners, if more than one, and your investors own after you subtract what you owe from your assets.

The shareholder’s section of your balance sheet should also include:

The par value of common stock

The par value is a number that represents the amount of money received for whatever it is that the business has issued. The par value of a stock represents the actual price you are paying to buy your own shares of stock.

Additional paid-in capital

Additional paid-in capital is an area where a business has received more money than the par value of its stock. This can occur through employee stock options, retained earnings, or other means that allow shareholders to purchase more shares for less money than the market price.

Sometimes a business will have to sell off stock for less than they are worth. This is called treasury stock and is the opposite of additional paid-in capital. When this happens, the difference between what was sold and what it was worth must be included as a liability on the balance sheet. This often occurs when a business will buy back its own shares to raise cash for other uses.

Retained earnings

This is the amount of money left over after a business pays all operating expenses, taxes, dividends, and other liabilities. This surplus is included in the owner’s equity section of the balance sheet.

While similar, paid-in capital and retained earnings are two different things. Retained earnings is money left over after a business pays all of its expenses, additional paid-in capital is money paid in that is in excess of the par value of shares.

What is the relationship between a balance sheet and your income statement?

Your balance sheet is a snapshot of your business’s financial standing at a given point in time and includes your assets, liabilities, and owner’s equity. In contrast, your income statement, or profit and loss statement will give you the totals for these same things, but over a period of time such as one year.

What is your cash flow statement?

The last major financial document is your statement of cash flows. Your cash flow statement shows your business’s cash and other liquid assets were over a period of time, the amount spent or received in each category (operating, investing, financing), and an ending balance.

Operating funds are all project-related activities while investing funds represent money going into the business’s investments such as property or equipment. The last category, financing, represents activities related to debt and equity transactions such as issuing bonds or shares.

How to analyze your balance sheet?

Now that you have learned all of the components making up your balance sheet, how it relates to your other main financial statements: your income statement and cash flow statement, we are now going to go over important information that you should know. These are factors that prospective lenders that you want to borrow from will look at to assess your financial position.

Financial statement analysis primarily looks at whether or not your business can remain in business. Balance sheet analysis primarily includes measuring three key accounting formulas: working capital, the current ratio, and the quick ratio.

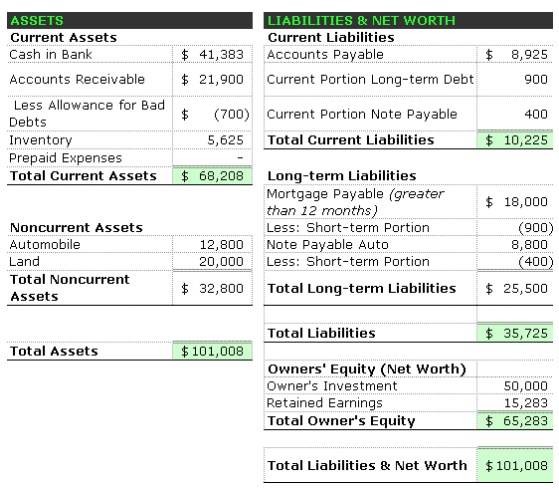

Using the sample spreadsheet below, we will look at these numbers.

Working capital

The working capital ratio is an important indicator for a business’s financial health, the ability to continue operating its business. A high working capital ratio means that the business will have instant access to funds, and no stock market dilution. As long as the business operation proceeds as usual, then a high working capital would be considered a good indicator of financial health.

Working capital is defined as current assets – current liabilities

68,208 – 10,225 = 57,983

In this example, working capital is more than enough to pay down current liabilities of $35,725 coming due. Cash alone of $41,383 can more than cover current liabilities coming due as well. This can also be an indication that the company profiled in the example above has too many resources that can contribute to growth sitting in cash.

Current ratio

A current ratio is the most frequently used measure of liquidity. It is calculated by dividing current assets by current liabilities, not total liabilities. The higher the ratio, the greater a business’s ability to pay off its short-term liabilities. In other words:

Your current ratio is equal to current assets/current liabilities. In the example above:

68,208 / 10,225 = 6.67

The current ratio is high reflecting a high cash balance and high account receivables.

Quick ratio

The quick ratio is a liquidity ratio that represents the proportion of short-term, highly liquid assets relative to short-term, highly liquid liabilities. Your quick ratio is (current assets – inventory)/current liabilities.

(68,208 – 5,625)/10,225 = 6.1

The current ratio did not make that much difference from the current ratio, reflecting lower inventory levels compared to other assets. This begs the question, is inventory too low? This depends upon how quickly the sample company can turn over its inventory. If inventory sells quickly, this company may run out of inventory, negatively impacting sales.

Wrapping it all up

Hopefully, in this post, you learned how to manage your balance sheet for success and the important role they play in running a successful small business.

If you need funding for your business, whether it be an SBA loan or merchant cash advance, we can help. Contact us or call (800) 795-3919 to get started today.